How to get paid quicker: Payment demand emails and letter templates

Photo: Canva

When you've done the work, you should get paid. It's as simple as that.

If you want to get paid quicker, this article will show you how to:

Build a solid payment structure into your daily business habits.

Use proven psychology for following up on late payments.

Fire off a payment demand letter that gets $25,000+ results within days (get the template version here).

Increase the chances of your invoices getting paid on time with three easy-to-implement ideas.

Imagine if you or I went to the supermarket, piled the trolley full and then left an IOU note at the self-service checkouts.

Unfortunately, this is what many service providers face. From painters, freelance writers, plumbers, graphic designers, electricians and many more, lots of service providers get paid after they provide a service.

These businesses often struggle to maintain cash flow.

If this sounds like you, perhaps you haven't built a strong payment timeline into your business dealings, maybe you're not sure how long to wait before following up with a payment request or you just don't know how to word the payment reminder without sounding rude or needy.

Are you looking for a Template for your Payment Request Letter?

You can download yours for free below from our Digital Resources Store.

Run the numbers & check your details

Before you launch into payment reminder mode, first you need to make sure you have all the details correct.

Was the invoice you sent correct?

Did you actually send the invoice?

Has the correct person received the invoice?

Did you post or email the invoice to the correct address?

When was the invoice due and has the due date passed?

Once you are sure you have an overdue account... time for next steps!

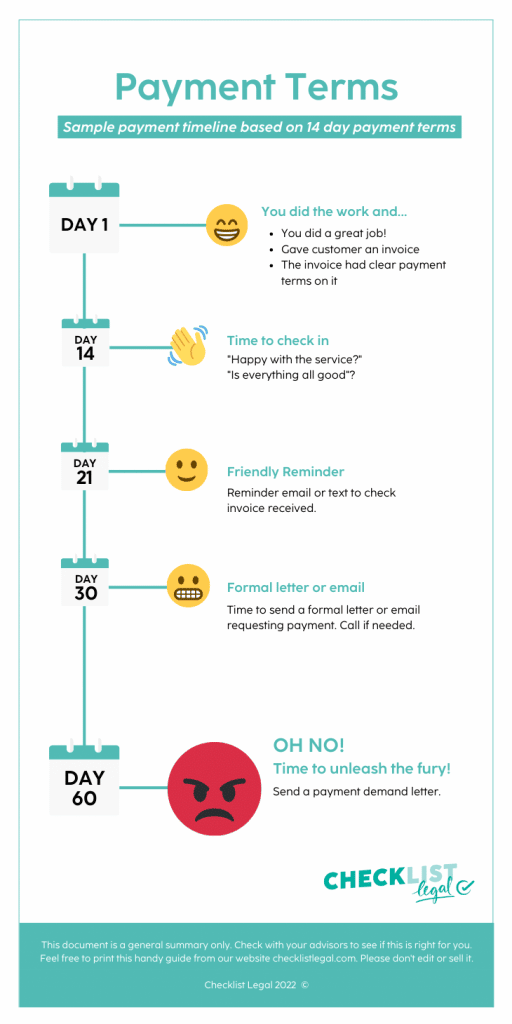

How long should I wait before sending a payment reminder?

How long you choose to wait before reminding customers may depend on the type of business you have and the type of customers.

If your payment terms are 14 days, you might want to wait a further week. Other businesses chase all overdue accounts at the same time each month, regardless of how overdue the amount is.

You should consider what you think is reasonable and what cash flow blows you can take.

Solid payment terms

Set up standard payment terms and stick to them.

If you have been more relaxed about payments in the past, make sure your regular customers are aware of the change, perhaps with a call and a follow-up email, to let them know that in the next month or quarter, you are moving to 14-day payment terms.

Feel free to point to your accountant, a new bank account, upstream supplier costs, new invoicing software, or any other factors as bringing about the change.

Have a set timeline for payment

1. Job Completed: Do what you do best!

2. Send: If you didn’t leave the customer with an invoice on the day, post or email an invoice as soon as possible – the sooner you send the invoice the sooner you get paid. Clearly state the due date and when you expect to receive payment.

3. Courtesy: On the due date, consider checking in as a courtesy to ensure there are no issues with the products and services provided. No need to mention payment, just a friendly check in to keep your business front of mind for the customer.

4. Friendly: 7 days after the due date, consider sending a brief follow-up reminder for payment, keep it light and friendly. Make sure you have the details correct (see above) and then send a short email (see below example) or consider the below sample phone text message if that's how you communicate with customers.

Example of a Friendly reminder text

“Hi! Hope you’re well. Just following the invoice sent on 15 June to office@company.com. Could you please check it was received? Happy to resend if you need. Otherwise, please send payment this week. Thanks!””

Example of a Friendly reminder email

“Hello Miss Customer,

Hope you are well and the [PRODUCT/SERVICE] is still working nicely. Just a quick note to follow up the invoice that I sent / emailed on 15 June as I haven’t received payment yet.

Could you please check if it was received? I’ll be happy to resend if you cannot locate it. Otherwise, I look forward to receiving payment within a week.

Let me know if you have any questions or I can help with anything further?

Thanks for your help and look forward to speaking again soon!

Kind regards,

Ms Rider”

5. Formal: When payment is two weeks or more late, it’s time for a more formal letter that firmly reiterates your right to payment. The below sample text utilises a psychological tool known as social proof, which tends to encourage people to pay because other people already have.

Example of formal reminder email/letter

“Hello Miss Customer,

I’m following up the invoice Isent/emailed on 15 June as we haven’t received payment yet.I’ve attached/enclosed a copy for your reference.

Payment was due for the [PRODUCT/SERVICE] on 30 June and we are now two weekspast the due date so would like to receive payment at your earliest convenience.

All other payments for other jobs in June have been received in full, so I’m sure you can understand it would be great to finalise this payment to close off our accounts for the month.

We really enjoyed working with you so please let me know if you have any questions or if I can help with anything further?

Otherwise, we will look forward to receiving payment by the end of the week.

Thank you for your assistance.

Yours faithfully,

Verity”

6. Demand: If the first (or second) friendly reminder doesn’t get the money rolling in, it might be time to play it a little more firmly. There are a few important points you need to include in a demand for payment.

How much is owed

Why it is owed / what it is owed for

When it needs be paid

A warning that you will consider legal action not paid within a certain amount of - time

A clear subject line such as Letter of demand or Final Demand shows you are serious about getting paid

Send it addressed to the owner (not the accounts department)

To make life easier… just edit the relevant details in this template.

I used a similar version of this letter when friends had tried for months to get a direct debit provider to pay up around $25,218.61 as agreed in a partly written and partly oral contract.

My friends got their money after a similar letter in less than a fortnight.

Get paid upfront!

If you hate chasing up payments, the best defence is a good offence.

Ask people to pay on the day of providing services wherever possible or at least for upfront costs such as materials.

Get paid on time

Encourage clients to pay on time, every time, by offering them an incentive.

Offer a pay on time discount

“People seek pleasure and avoid pain”

Offering a pay on time discount introduces a bit of FOMO (fear of missing out) into the equation. You can tap into the Pleasure Principle and the Regulatory Focus Theory – people seek pleasure and avoid pain. If customers think they can get a discount for paying on or before the date on the invoice (pleasure) and also avoid the higher price point for payment after the due date (pain).

Bribes for the admin team

Flowers, birthday cards, a bottle of sparkling at Christmas, just because treats and other simple gifts for those who actually make the payments happen will go a long way to putting your invoices at the top of the pile each month. Always be polite and courteous to all office management staff.

Tap and go mobile card reader and Virtual Payments

(Check out some of PayPals latest options here)

In the last couple of years we’ve become very familiar with how to use QR codes. Payment services such as Paypal now make it easy for business owners to take payments by a QR code. Get instant payment from your frequently late payers via this cashless cardless touch free option and see if it makes a difference!

Photo source: Canva

So, let’s go get this money!

Try out the template for those long term overdue payments

Test out methods to entice your customers to pay on time

Decide on what you want your payment terms to be – and apply them consistently

I’d love to hear how you go with the template or any other ways you encourage clients to pay you on time.

And I’d love to hear what methods you use to ensure you get paid on time?

One Final Tip: The Australian Government has lots of help for small businesses including around payment demand letters. Here is handy article from business.gov.au for how to write a letter of demand.